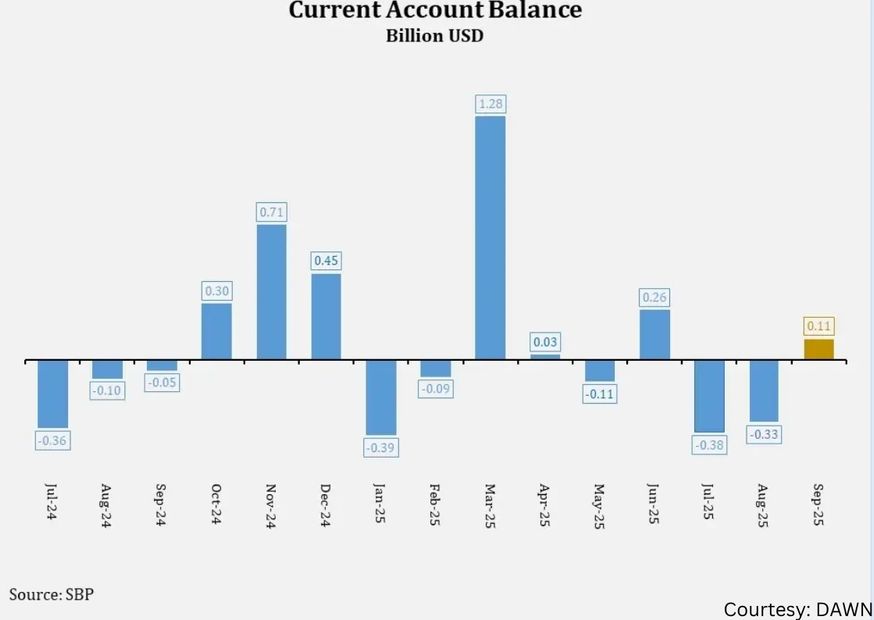

KARACHI, PAKISTAN: In a rare and encouraging sign for the economy, Pakistan posted a current account surplus of $110 million in September, reversing two consecutive months of deficit. The improvement has sparked cautious optimism among financial experts who believe it reflects early signs of stability, though challenges remain.

According to the State Bank of Pakistan (SBP), the country had earlier recorded a combined deficit of $624 million in July and August of the current fiscal year, compared to $430 million in the same period last year. The September surplus, however, suggests that inflows — particularly through remittances and services — helped offset the trade gap for the month.

During the first quarter of FY26, remittances remained stable, exceeding $3 billion, while service exports rose to $2.2 billion. Despite these positive indicators, overall exports stood at around $7.9 billion, whereas imports increased to $15.4 billion, highlighting that the underlying trade imbalance remains substantial.

Meanwhile, foreign direct investment (FDI) witnessed a sharp decline of 34 percent year-on-year, falling to $568.8 million from $864.6 million a year earlier. The biggest drop was seen in Chinese investments, which fell from $502.6 million to $188 million — a worrying sign given China’s role as Pakistan’s largest investor under the CPEC framework.

Economists caution that while the September surplus offers temporary relief, it does not signal a long-term turnaround. With the trade deficit widening to $9.37 billion in the first quarter compared to $7.05 billion last year, sustaining balance will require stronger export growth, reduced import dependence, and renewed investor confidence.

As Pakistan braces for higher global commodity prices and potential foreign exchange pressure, the government’s fiscal discipline and energy policy decisions in the coming months will be key to maintaining this fragile stability.

This story has been reported by PakTribune. All rights reserved.